Coverage you need to protect your vehicle is more than the minimal Montgomery car insurance.

Don’t let this guy make you sorry that you only opted for the minimum required Montgomery car insurance.

Drivers in Alabama are told that they have to carry the minimal Montgomery car insurance to protect themselves. But, the actual protection afforded by the required Montgomery car insurance only protects you from having to pay for all the damages that you cause to another person or their property. This coverage does not pay for the damages to your own vehicle.

Basic Montgomery Car Insurance

The State of Alabama requires that all drivers within the state carry the following car insurance coverages:

- $25,000 in coverage for damage to another’s property

- $25,000 in coverage for medical expenses related to injuries you cause to another person

- $50,000 in coverage for medical expenses related to injuries you cause to another person

The above coverages are liability coverages and do not pay anything if something happens to your own vehicle. So if your vehicle gets hit or stolen, you will have to pay for it out of your own pocket.

Protecting Your Vehicle From Theft

If you are worried about your vehicle being stolen, but you can’t afford more than the minimum required Montgomery car insurance, per the Montgomery, Alabama, Code of Ordinances you can participate in the Combat Automobile Theft program.

“Sec. 27-7. Combat automobile theft program.

(a) The city police department shall implement an automobile theft prevention program to operate as follows:

(1) Motor vehicle owners who desire to enroll their vehicles in the automobile theft prevention program shall execute consent forms which will authorize the owners involvement in the program. A consent form signed by a motor vehicle owner provides authorization for a law enforcement officer to stop the vehicle when it is being driven between the hours of 1:00 a.m. and 5:00 a.m., provided that a decal is conspicuously affixed to the bottom left corner of the back window of the vehicle to provide notice of its enrollment in the combat automobile theft program.

(2) The combat automobile theft program decals shall conform to the specifications established by the state department of law enforcement. The decals shall be yellow in color and will be issued to owners who enroll in the program. The decal shall be placed on the bottom left corner of the back window of the automobile.

(3) An administrative fee of $2.00 shall be established to cover costs of the program. The police department shall collect the fees from all program participants.

(b) The vehicle owner shall be responsible for removing the decal when terminating participation in the program, or when selling or otherwise transferring ownership of the vehicle.

(c) No civil liability will arise from the actions of a law enforcement officer when stopping a vehicle with a yellow decal, evidencing enrollment in the program, when the driver is not enrolled in the program, provided that the stop is made in accordance with the requirements of the combat automobile theft program.

(d) This program shall be implemented upon issuance of written program materials and procedures by the police department.”

Unfortunately, if your car thief doesn’t get caught with this program then you will have to pay for a new car out of your pocket. So it would be best to use, but not depend on the Combat Automobile Theft program.

Additional Montgomery Car Insurance

Another way to protect your vehicle in the event that it is stolen, is to purchase comprehensive car insurance. This coverage covers any damage that happens to your vehicle that is not a collision, which includes the insurance paying actual cash value for the vehicle if it ever gets stolen.

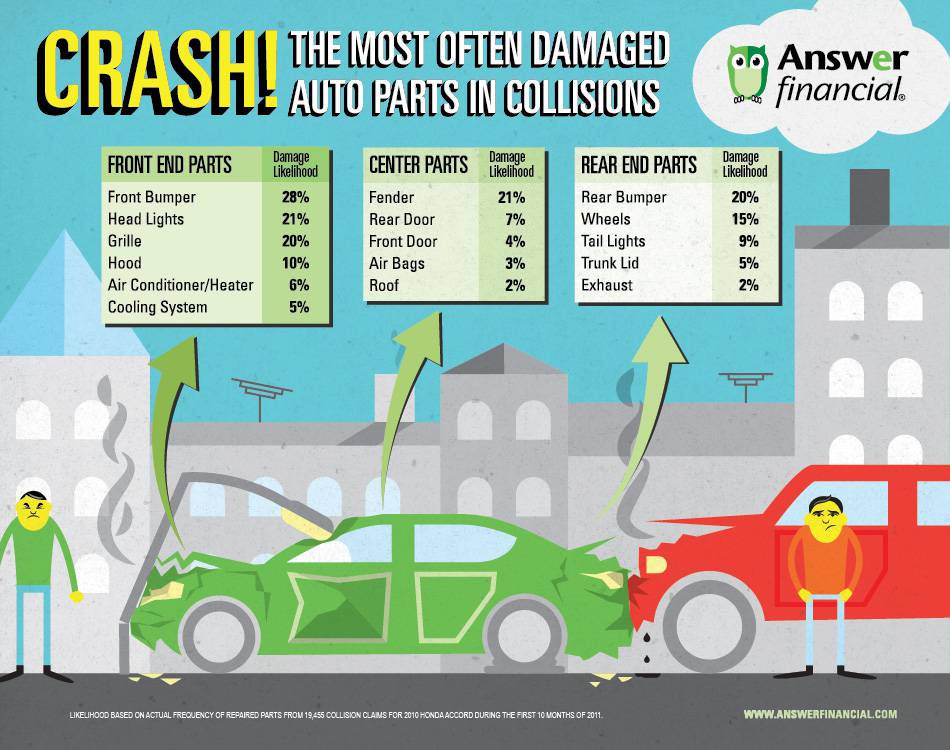

Another coverage that you should have is collision coverage. This coverage will pay for the damages to your vehicle in the event of a car accident, damages that are not covered under the required Montgomery car insurance laws.