The Story of Property and Casualty

What property and casualty insurance is, the history of property and casualty insurance in general and auto insurance in particular, and how it all ties in to save you money.

Your local auto insurance agent is probably what’s referred to in the insurance industry as a “property and casualty,” “P&C,” or “multi-line” agent. What does that mean, anyway?

Well, it means that he or she sells and services more than just auto insurance. While there’s plenty to write about auto insurance (and believe us, we’ve proven it), it’s just the tip of the iceberg when it comes to the larger insurance realm.

Auto insurance is part of a larger group of insurance types, or “lines” as they’re known in the industry, known as property and casualty or P&C. Other forms of property and casualty insurance include homeowners, renters and most commercial and general liability insurances.

Most states require a special type of insurance license to sell and service property and casualty insurance. Because most large auto insurance carriers are multi-line companies, they require their agents to be property and casualty generalists as opposed to auto insurance specialists.

A Short History of Property and Casualty

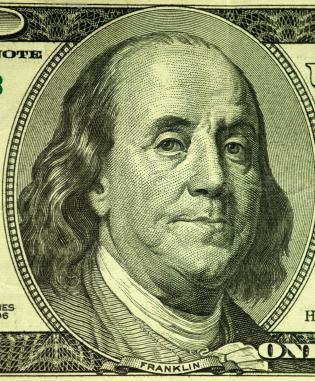

Crude forms of property and casualty insurance can be traced all the way back to Hammurabi’s Code in ancient Babylonia. Actuary tables developed by Blaise Pascal were in use in Europe in the 1600s. Property and casualty insurance in America can be traced back to 1752 Philadelphia, when a group of property owners banded together to form the Philadelphia Contributionship for the Insurance of Houses from Loss by Fire. The prime mover in this organization? None other than Benjamin Franklin, who later had a hand in forming the first life insurance company in America as well.

In addition to forming the precursor to homeowners insurance and therefore the beginnings of property and casualty insurance in America, the Philadelphia Contributionship also pioneered underwriting techniques by refusing to insure houses that were considered unacceptable fire risks (and in 18th Century Philadelphia, there were a lot of those) as well as ushered in some of the country’s first zoning ordinances and building codes.

The History of Auto Insurance

Auto insurance, of course, came a bit later in our history with the advent of the automobile itself. The first recorded auto insurance policy was written by Travelers in 1897 for Dayton, Ohio, resident Gilbert J. Loomis. Loomis paid a cool $1,000 – a fortune in 1897 – for a policy that covered only property damage, bodily injury or accidental death. In other words, a liability only policy.

Auto insurance began to assume its modern form in the 1920s with the formation of companies like State Farm in Illinois and Farmers in California, both founded on the premise that farmers were safer drivers than the general population. Although harder statistical data is used today, the same basic concept that some groups are cheaper to insure than others remains a central tenet of auto insurance marketing and pricing.

How It’s Related

Underwriting in all property and casualty lines is driven by statistics. What’s more, auto insurance discounts are often available by purchasing other property and casualty products from the same company. These “package discounts” are often a great way to get cheaper car insurance. Ask your agent for more details.

Trackback from your site.