Things Guaranteed to Increase Your Oxnard Car Insurance

Don’t let these traffic violations hurt both your wallet and your Oxnard car insurance rates.

Source: lincharlotte.com

Source: lincharlotte.com

No Tacoma car insurance = No driving

Traffic laws are meant to keep us safe, just like our parents did when we were kids. And when we did something we weren’t supposed that could put us in danger we were told no.

Even though we are adults now, things haven’t changed much. We still get told no that we can’t do things, especially behind the wheel of our vehicles that could put us in danger. Here are just a small number of the things in Tacoma drivers get told “no” they can’t do.

Tacoma seems to have cracked down on cruising, for the sake of citizen and traffic safety. Per the City of Tacoma municipal code:

Think that you can get away with breaking a traffic law just because there is no police officer around? Think again.

The City of Tacoma has automated traffic safety cameras installed all over to detect when a traffic violation is occurring. These cameras can capture:

When you are captured on camera breaking a traffic law, you will be sent a ticket in the mail within 14 days.

While the above traffic laws and procedures are city level issues, Tacoma car insurance laws are actually state level. The State of Washington is who makes all of the car insurance laws for drivers in the state, which are then enforced by law enforcement on all levels, including City of Tacoma police officers.

To prevent yourself from getting in trouble with any of these law enforcement agencies, always make sure that you are carrying at least the minimum required amount of Tacoma car insurance. If you aren’t sure what those minimum requirements are, we have provided the basics for you:

For more information on the required coverages you need to have to drive and the coverages you need to be fully protected, contact your Tacoma car insurance agent today.

Just because you have to purchase Fayetteville car insurance, doesn’t mean that you shouldn’t know what you are buying.

All drivers know that they are required to carry liability coverage on the Fayetteville car insurance in order to be able to drive. This requirement was created by the State of North Carolina and is required of every driver in the state, no matter where they live in the state.

However, even though drivers know that it is a requirement, most of them have no idea what these coverages actually take care of if they were to ever cause an accident.

The required bodily injury liability coverage only pays for damages to other people that were not in your vehicle at the time of an accident that was your fault. This coverage pays for medical bills, funeral expenses, disability payments, lost wages, rehab treatments (physical therapy, etc.), pain and suffering settlements, legal expenses, and law suits.

Property damage liability coverage pays for damages that you cause to another person’s property. This can include a vehicle, a home, a yard, or even traffic devices and equipment owned and maintained by a government entity (stop signs, guardrails, etc.). This coverage will pay to repair the damage you have done, or if it cannot be repaired then actual cash value will be offered for the item.

Supplementary payments are payments that are made in addition to the above coverages. Your agent can give you the details of your policy’s specific limits for these coverage and any exclusions that may apply.

These supplementary payments can include:

Please take note that these items that are paid out by your insurance company are just about always for someone else other than you. If you want your interests protected also, talk to your Fayetteville car insurance agent about what other coverages you need on your vehicle to protect yourself.

(Source: ncdoi.com)

When purchasing car insurance there are usually two groups of people. The first group just wants the bare minimum that they can get away with to be able to legally drive in their state. The second group wants to know how much car insurance coverage they really need to be protected financially if they ever are in a car accident.

For those that are in the second group, here is a great infographic from Bankrate.com to give you an idea where to start. Before you choose your own car insurance cover limits though, always consult your car insurance agent first.

It is no secret that people don’t like paying for car insurance. They are forced to purchase it, and unless they get into an accident it’s something that is paid for but is never used.

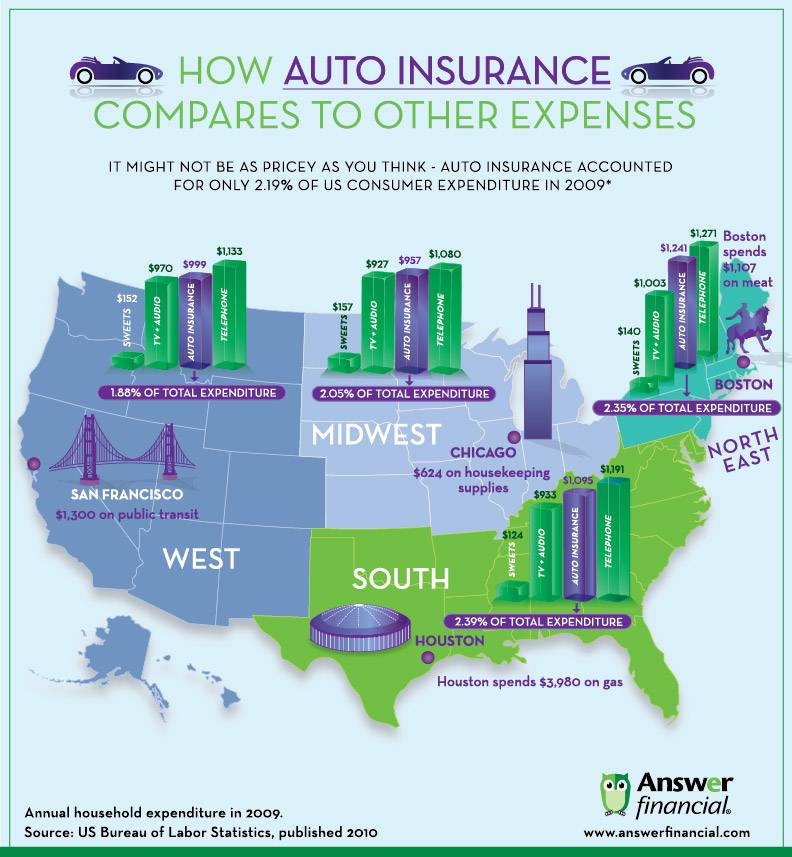

In the past we have talked extensively about how important it is to have car insurance, so we won’t cover that again today. Instead, we found this interesting graphic from Answer Financial that shows just how much of your income that auto insurance really uses, compared to other expenses in your life.

Yes, the numbers are from 2010, but the comparison still holds true today.