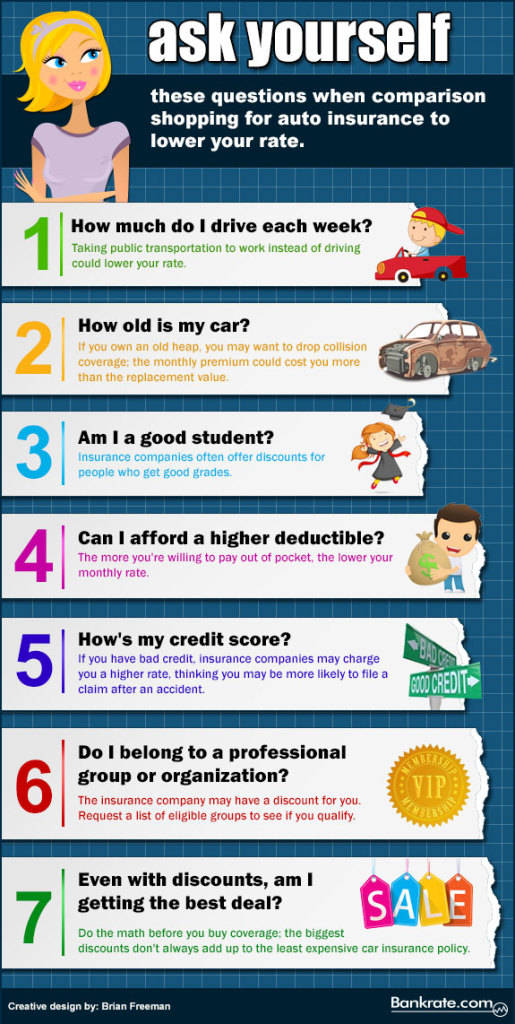

Can Insurance Rates be Reduced?

Q: I had an at- fault accident earlier this march. Geico paid for the damages and the other party. Usually I go for six months plan and it would cost me around 265 dollars. But after this accident and on renewal they have hiked my six months plan rate to nearly 475 dollars. This was my first at-fault accident and there was no ticket from the police since it was a fender bender and the other driver was driving with a suspended license. I never got a traffic ticket till date. Is there any way I can talk to Geico to reduce the plan rate. As I see they have increased it by nearly 80%.Please let me know your suggestions. Thanks.

A: Insurance rates are a set in stone kind of thing, there is no way to get them to reduce the rate. Your only option would be is to go to another insurance company that might be able to give you better rates.