Beyond the Basic Moreno Valley Car Insurance

The basic required Moreno Valley car insurance coverages are not enough to protect your own car.

The State of California only requires that you carry enough car insurance to be able to pay for the damages that you cause to another person or vehicle. These coverages and their limits are:

- $5,000 in liability property damage coverage

- $15,000 in bodily injury liability coverage per person

- $30,000 in bodily injury liability coverage for the entire accident if multiple people are injured

These coverages are known as “liability coverages” and they do not pay for any damages that may happen to your vehicle. If you want your insurance company to pay for the damage to your vehicle, you will need other types of coverage added.

What Other Moreno Valley Car Insurance Coverage Do I Need?

In order for the damages to your vehicle to be paid for, you need to purchase comprehensive and collision coverage from your Moreno Valley car insurance agent. Collision coverage will pay for damages to your vehicle if you hit something and comprehensive coverages pay for damages caused by things like animals.

These coverages are optional, but if you don’t get them you will have to pay for your car to be fixed with money from your own pocket.

Do I really Need These Other Moreno Valley Car Insurance Coverages?

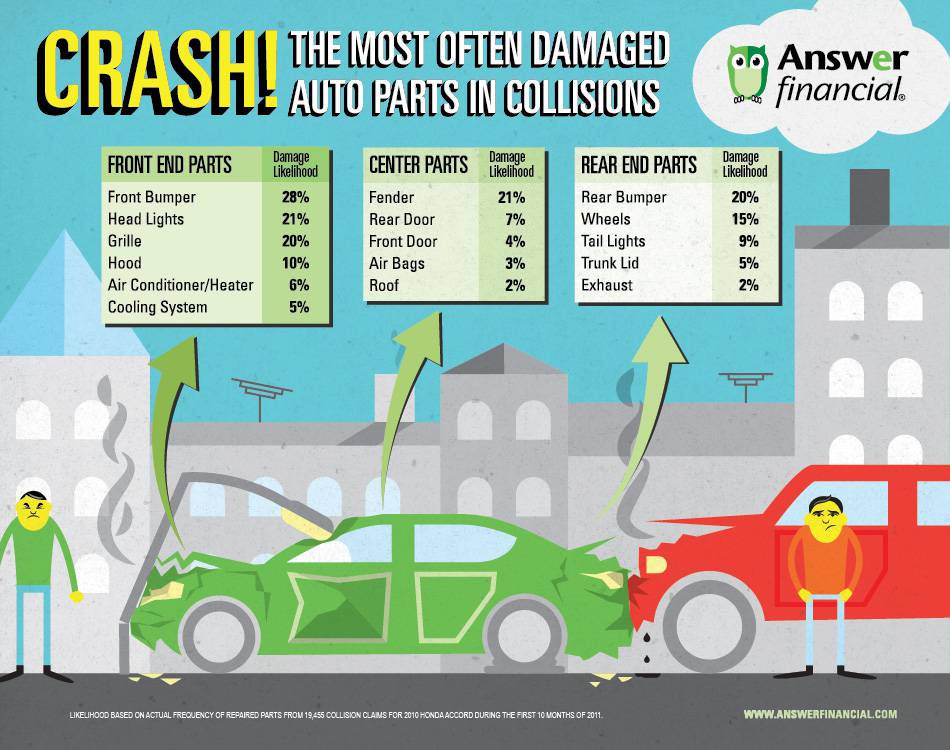

If you are wondering if purchasing comprehensive and collision is worth it, consider the following infographic from Answer Financial.

So the question you need to ask yourself is, can you afford to fix the parts listed above if you chose to go without the extra Moreno Valley car insurance?

Trackback from your site.